What Is NIL?

NIL in college sports stands for “Name, Image, and Likeness,” referring to college athletes’ rights to profit from their personal brandstudyandplayusa.com.au. In other words, players can now sign endorsement deals, receive sponsorships, monetize social media posts, and earn money for advertising themselves without losing NCAA eligibilitystudyandplayusa.com.auncaa.org. The NCAA allowed this change starting July 1, 2021ncsasports.org after years of debate and legal battles. For example, a landmark 2009 court case (O’Bannon v. NCAA) challenged the old rules by noting that a star player’s likeness was used in a video game without compensationecckersports.com. The NCAA now officially supports these new opportunities and even set up an educational NIL Assist platform for student-athletesncaa.org.

All college athletes can benefit, not just star quarterbacks or point guards. Any student-athlete – football, basketball, soccer, track, etc. – can seek student-athlete sponsorships or athlete endorsements under NIL. The NCAA explains that players may “endorse products, sign sponsorship deals, [and] monetize their social media presence”ncaa.org. Major brands are already involved: for example, companies like Nike, Adidas, Gatorade, Beats by Dre and Chipotle have signed deals with college playersstudyandplayusa.com.au. In short, NIL has unlocked a wave of student-athlete sponsorships and college sports marketing, as schools and sponsors treat athletes more like professional brands.

How It Works for Athletes

College athletes can use NIL to partner with companies or promote brands in many waysncaa.org. For example:

- Endorsements and Sponsorships: Wearing a company’s logo or appearing in ads as a brand ambassadorncaa.org.

- Social Media Promotions: Posting paid content on platforms like Instagram, TikTok or Twitterncaa.org.

- Appearances and Camps: Paid autograph signings, fan appearances, photoshoots or running sponsored sports camps.

- Merchandising and Licensing: Licensing their name or signature for products (trading cards, video games, posters, etc.) or selling autographed gear.

These options let players earn money much like online influencers or celebrities. The NCAA still bans direct pay-for-play (athletes can’t be paid just for on-field performance), so NIL deals rely on the athlete’s popularity and marketabilityncaa.org. For example, Alabama’s Bryce Young is a college quarterback (the player who typically throws the football). He reportedly earned about $1 million in endorsement dealsvistex.com. (In American football, running or catching the ball in the end zone is called a touchdown (worth 6 points); Young threw 30 touchdown passes in 2021 but earned money only from sponsor dealsvistex.com.)

Other stars have big deals too. Iowa’s Caitlin Clark (women’s basketball standout) signed with Nike and in 2023 became the first college athlete featured in a State Farm ad campaignbusinessinsider.com. Fresno State basketball twins Haley and Hanna Cavinder (with huge social-media followings) each landed five-figure NIL deals almost immediately after rules changedvistex.com. Even players from smaller programs profit: Tennessee State’s Hercy Miller reportedly signed a four-year, $2 million shoe endorsementvistex.com.

Many athletes build their personal brand on social media to boost these opportunities. However, international players face extra limits: most foreign students hold visas that prohibit working in the U.S.espn.com.ausportsnet.ca. For example, UConn’s Adama Sanogo (from Mali) and Miami’s Norchad Omier (Nicaragua) found they could not pursue NIL deals while in the U.S.espn.com.au. Instead, they often wait until they are home. Miami’s Australian punter Harrison “Mase” Hedley filmed a promotional ad in Australia and earned roughly $50,000 (all done on Australian soil)spectrumnews1.com. Nebraska’s Australian players Jaz Shelley and Isabelle Bourne plan to do their NIL work during future trips to Australiaspectrumnews1.com.

You can also read about History of Sports

Impacts on Teams and Schools

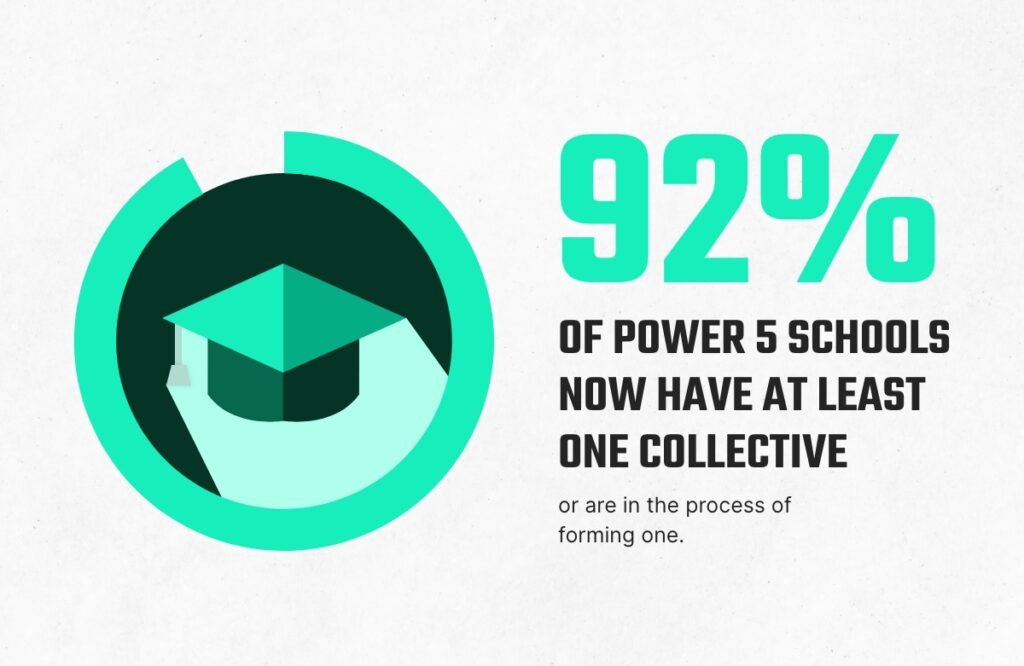

NIL quickly became part of team strategy and recruiting. Wealthy booster collectives now raise money to help athletes at certain schools. This has turned recruiting into an almost open spending race. For instance, Tennessee’s Spyre Sports collective raised enough to promise an $8 million NIL package to a top quarterback recruitsi.com. Booster networks at Texas A&M, Nebraska and Miami have similarly funneled millions (about $6M at Texas/Nebraska each and $7M at Miami) into deals for athletessi.com. Even college coaches have noticed: Alabama’s coach Nick Saban quipped that a rival school “bought every player” with NIL moneysi.com. One industry analyst even noted that some programs’ athletes are on pace to out-earn their coaches through endorsementssi.com.

Schools and conferences are adapting. Many colleges have set up NIL compliance offices to help athletes find and report deals. The NCAA itself launched an NIL Assist portal (with Teamworks) to provide education, a directory of approved agents/providers, and tracking toolsncaa.org. Athletic departments include NIL info in recruiting pitches, highlighting local sponsorships or campus collectives. They enforce guidelines to avoid conflicts (for example, ensuring deals don’t violate team sponsorship contracts). Some also watch equity issues: currently, football and men’s basketball dominate NIL dollars (over 90% of itreachcapital.com), which raises questions about supporting women’s teams. In general, NIL has added a new layer to college sports management and marketing: it can boost recruitment and keep players in school, but it also forces ongoing policy updates and oversight.

Business and Sponsorships

From a business perspective, NIL has created a college sports marketing boom. Companies now treat student-athletes like influencers. Large brands and local businesses alike pursue sponsorships and endorsements with college players. In 2023–24, analyst reports tracked roughly $1.17 billion in NIL activityreachcapital.com, with projections to $1.67B in 2024–25. Football programs capture most of this money – about 72% of the spending goes to FBS football playersreachcapital.com – followed by men’s basketball (about 21%), while women’s sports receive only a small slicereachcapital.com. Social media drives much of it: roughly half of NIL income today comes from sponsored online posts, and experts say if this growth continues, the college NIL market could surpass $2 billionvistex.com.

Figure: Estimated NIL market activity by sport. Research shows over $1.17B in deals (2023–24), with Power-5 college football getting the largest sharereachcapital.com.

Tech platforms and agencies have sprung up to handle NIL marketing. Firms like Opendorse and INFLCR help manage deals and collect data. New products have emerged – for example, trading-card company Panini now pays college athletes to use their images, and video-game publishers negotiate licenses with athletes. Even local ventures get involved: restaurants, apparel shops and gyms sign players to endorsement gigs in their communities. In short, NIL is now a key piece of college sports marketing. The landscape has become something of a “Wild West,” as one commentator put it, with donor collectives and brands making big offers to recruitssportsnet.ca. Today’s NIL world is illustrated best with charts and graphics – for example, a timeline of NIL legal changes (2009 court cases through the 2021 NCAA policy) or the bar chart above showing how sponsorship dollars flow into different sports. Such visuals help show how quickly and dramatically NIL has changed college athletics.

Sources: NIL rules and examples are documented by the NCAA and news outletsstudyandplayusa.com.auncsasports.orgncaa.orgvistex.combusinessinsider.com. Interviews and reports from ESPN, Sports Illustrated and others provide data on athlete deals and budgetssi.comsi.comreachcapital.comvistex.com, illustrating the new era of student-athlete endorsements and college sports marketing.